With ESG interest at an all-time high, companies need to start building environmental, social and corporate governance – or ESG considerations into their core business strategy and operations. With so much confusion in reporting standards, metrics, ratings, and no clear ESG lead within most companies, how do you begin to measure what matters to whom? Here’s a three-step approach inspired by Eric Ries’ Lean Startup concept of MVPs you can use to begin gathering disparate information and efforts across the company and build a cohesive ESG strategy and disclosure plan.

Why is ESG different today?

Here are four dynamics I’m seeing that make the demands for ESG disclosure and progress different now vs. 10 years ago:

- Large equity investors, including BlackRock, not only want companies to provide more transparency, they are now demanding companies show real progress on ESG goals.

- The SEC’s proposed rules to disclose certain climate-related data starting in fiscal ‘23, if adopted, will further the need for companies to centralize their ESG approach internally.

- Consumers want to buy from companies that don’t greenwash.

- 60% of workers surveyed choose their employers based on the company’s beliefs and values […]

Despite the clear demand for ESG progress and transparency, internal teams still debate over who should own the ESG agenda. In order to make true progress, CEOs need to own the ESG agenda and champion change within the core business strategy and vision.

If you lead your company’s strategic planning process, it’s time to integrate sustainability, social, and governance work into your company’s resource allocation process so you can build sustainability into your core business model.

Where do you start? If you’re still thinking about which first step to take, you’re not alone. With the alphabet soup of ESG reporting frameworks, rating agencies, and impact goal coalitions, it’s easy to get overwhelmed.

The solution: Create what I call an MVD for your ESG strategy so your teams can get started.

How Do You Define Your Minimum Viable Disclosures for ESG?

Product teams and startups build an MVP, or minimum viable product, to prototype through quick iterations. […] Think like a startup and build your most viable disclosures, or MVD, for your ESG “product” – the version of your new ESG program that allows your team to collect the maximum amount of validated learnings about stakeholders (your ESG “customers”) with the least amount of effort.

Creating an MVD provides two benefits:

- Prioritization: You gain an understanding of what specific topics in E, S, and G external stakeholders consider most material for companies in your industry.

- Conversation starter: The process allows you to have data-centered discussions with internal teams so you can identify what will take the most effort to advance.

Here are three strategic steps to take.

Step 1: Align your ESG strategy with your business objectives

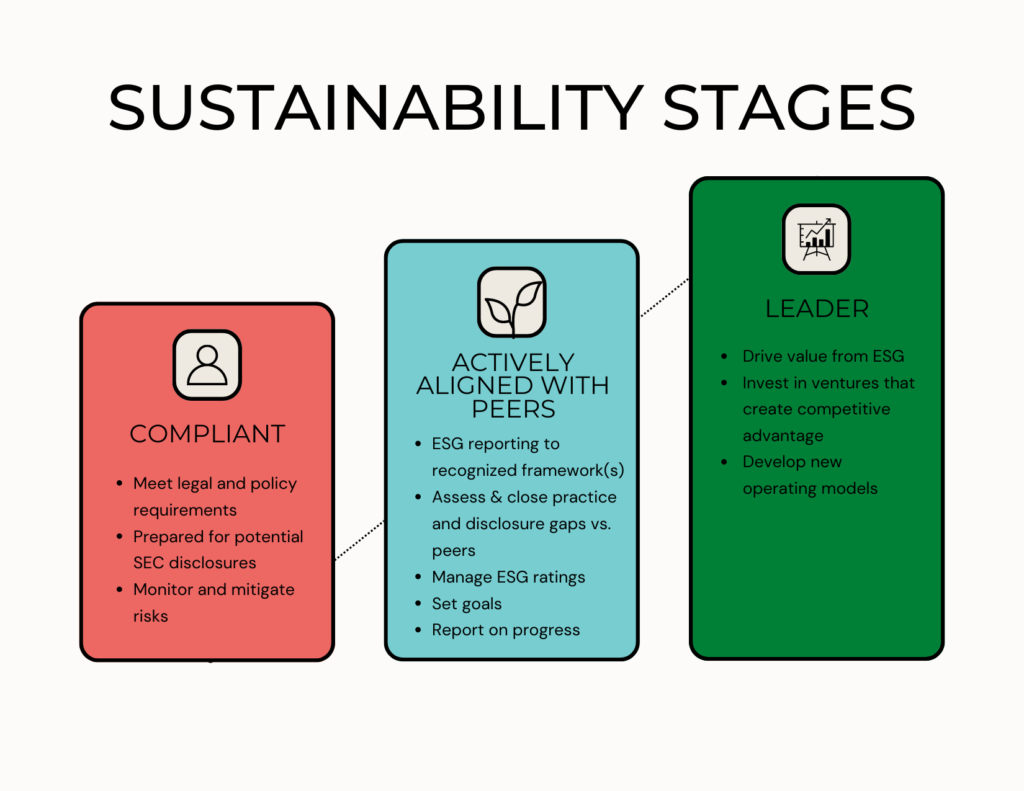

Before starting your list of ESG practices and disclosures, ask what your main goals are in the next 1, 5 and 10 years. There are 3 main places to be on the ESG spectrum – Compliant, Actively Aligned with Peers, or Leader. Determine where you want to be at which time frame.

Step 2: Identify Specific Gap Areas You Want to Solve or Improve for Stakeholders

Ask yourself: “If I had to report on ESG-related practices and metrics tomorrow, what might my ESG report look like?” Create an uber list of ESG-relevant data and programs in one central file so you can assess where you are, and identify data gaps, risks, and opportunities.

The most comprehensive way to do this is by performing a materiality assessment. But before you invest time and resources in performing a materiality assessment, you can get started by creating your MVD using materiality maps developed by ESG reporting frameworks commonly recognized in your industry – SASB is the most prominent in the US, GRI on a global basis; TCFD and others may be common depending on your industry practices.

Don’t stop there, add key metrics specific to your company that may not be covered by general frameworks. For example, if you’re in the food industry, you may track investments and revenue from alternative protein products as a sustainable initiative and product innovation. This is an important capability where no disclosure standard exists today.

Once you have the topic inventory list, have conversations with internal teams to identify what are the most painful gaps between your desired disclosure outcomes and your present state.

Step 3: Translate your MVD into an ESG plan of action

Once you have gathered all the metrics in one place, prioritize the ones with a potential material impact on financial performance (revenue, cost, profit, cost of capital), and on your company’s brand and reputation. These topics and metrics will likely be 80% of your ESG agenda and where you should begin allocating resources to solving.

One thing I’ve learned since my days at Disney handling corporate social responsibility (CSR) related investor inquiries, and it still holds true in my work with ESG clients today: ESG concerns are complex and nuanced. They require continued coordination across Finance, Investor Relations, Legal, Human Resources, Operations, Marketing, and Press Relations.

Solving the ESG challenge is about managing risk today and embracing ESG opportunities in your value creation playbook to proactively prepare for a low-carbon economy. The way to create lasting impact depends on building the case for ESG and linking them critically to how they create business value.

Learn more about how I help clients clarify their ESG agenda and reporting here.