Key Takeaway: Too often, public companies don’t recognize they have an investment narrative problem until they are too far along to course correct. Perform a check-up regularly on your investment narrative – also called your equity story – to ensure investors remain engaged and excited about your growth prospects. Here are three signs CFOs and Investor Relations Officers (IROs) should look for and steps you can take to build back the company’s credibility with investors.

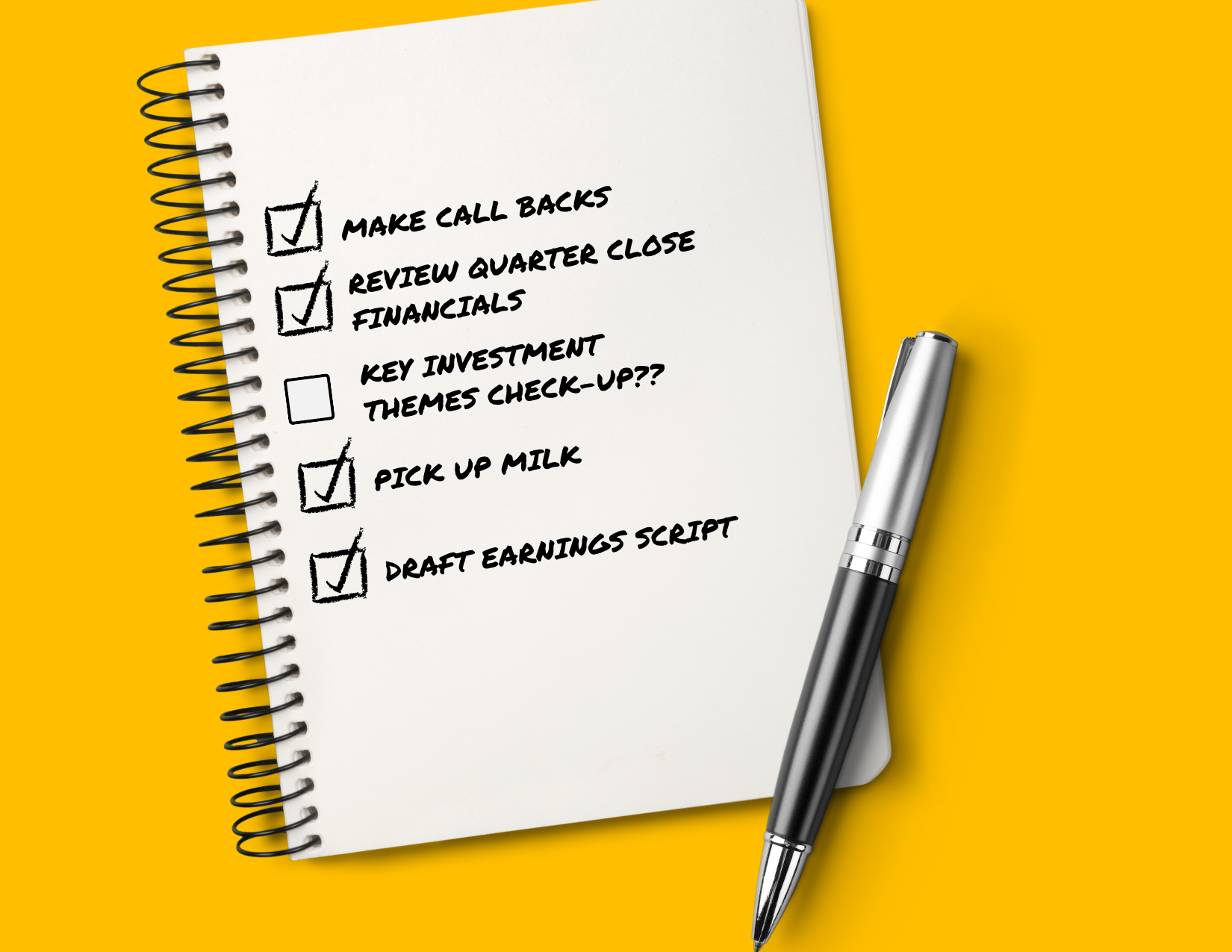

There are too many things keeping IROs up at night: staying on top of tomorrow’s big product announcement and questions that may arise, making all your investor and analyst callbacks before the quiet earnings period begins, and plotting next quarter’s non-deal roadshow. Did I mention earnings prep? Oh yes, I know, the list goes on.

But too often, they don’t recognize they have an investment narrative problem until they are too far along to course-correct.

- Sign #1: Right story, wrong time

- Sign #2: Product and sales decks don’t tell the same story about growth

- Sign #3: Investors keep asking about topic X, but they should be asking about topic Y.

What is an investment narrative?

A company’s investment narrative describes the most compelling reasons why institutional and retail investors should invest in your company. It threads the logic from macro trends to how you’re allocating resources and capital to capture these market opportunities. It’s a critical component of your investor relations program and influences your company’s valuation. Do it well and you will earn high credibility with investors.

CEOs often believe a business that performs well will sell itself. But taking a “we have confidence, just you wait and see” approach with investors may cause unnecessary fluctuation in your stock price near term and keep you from achieving the fair market value your company deserves, even when you deliver great results.

Here are three warning signs I’ve seen from my work helping late-stage and public companies develop their strategic messaging to investors.

Sign #1: Right Story, Wrong Time

Through no fault of your own, events outside your company’s control can put in question its ability to achieve long-term targets. For example, if you’re a food company affected by the current inflationary pressures in the US and your investment narrative relies on top-line growth through product innovation and higher pricing. Investors may wonder whether you can achieve your growth targets in the time you said you would. Other special situations include key executive turnover, major strategic moves from competitors, and macroeconomic disruptions (such as a pandemic).

Sign #2: Product and sales decks don’t tell the same story about growth

The product team works on launching the next new thing, which may not be ready for prime time yet, but the sales team will typically convey excitement for what’s coming soon in their sales pitch. If instead, your sales team keeps on reminding partners of existing core products without touching on innovation, that’s a sign they are either unaware of the product roadmap and its potential, or they don’t believe in it yet.

Sign #3: Investors keep asking about topic X, but they should be asking about topic Y

Say you’re a brick-and-mortar retailer launching a new store redesign, yet your investors keep on asking in five different flavors about your e-commerce sales. While investors often ask about the most recent trends or competitor moves, and how you’re responding to them, it’s the level of intensity in how they ask that you should listen for. It may signal a perception gap between your strategy and what they believe it is or should be.

What Investor Relations Officers should do

- Investigate internally

Ask hard questions of your internal teams and investigate what may be going on, and what additional information exists to help you understand. Play devil’s advocate and ask, “If I’m putting on my investor hat [substitute in the name of your top active buy-side analyst], here are the questions I would have…” How would you answer that? What data or proof points do we have to back up what we say? If the answers aren’t satisfactory, it’s a sign this is not just a messaging issue, it’s a strategy or internal alignment issue.

- Proactively address the “elephant in the room” topics with investors as they arise, even if you don’t yet have a solution for them

Ask yourself what proof points you can share to show you are making the necessary decisions to address the specific challenge head-on in your next earnings call or public speaking engagement. This includes addressing topics that may seem small but keep on surfacing.

Keep a log of questions that keep coming up during investor calls over a longer than usual period of time. You know your business best and probably instinctively know how much time is considered to be long, but I should think any topic that comes up for more than 3 consecutive earnings calls should be reconsidered.

- Take action

- Get Data: Perform a perception study, even an informal one, to confirm the top investor concerns. Get quantifiable data over a set of investors and analysts, so your data points are no longer considered ‘anecdotal.’

- Hold an Investor Day: It’s the most efficient way to refresh your investment narrative. Even if you don’t think internal teams are ready to talk about a new strategic direction yet, making the case for holding an Investor Day with your executive team and the board creates a sense of urgency. It forces people to collaborate with you and think about the big strategic questions you must answer for investors.

A company’s investment narrative isn’t only an investor relations problem, it’s a company problem. Besides affecting the company’s stock performance, it shows up in sales, operations, and marketing as a lack of clarity in strategy and execution. It requires collaboration between IR, strategy, operations, finance, sales, and senior leaders across the company to address the most difficult questions and make strategic choices on how to win and how you will get there.

I write about topics that straddle strategy and finance. If you found this helpful, please share it. I appreciate your support.

Learn how I help clients build their own investor relations playbook here.