People forget facts and figures, but they remember great stories. There’s a reason we use fairy tales to teach our kids good values and moral lessons. The best songs, books, and movies tell powerful stories that move us, inspire us, and touch our hearts. Human beings are storytelling creatures. It’s our superpower.

In the business realm, data is the currency of decision-making. But raw data alone, even with your best insights and charts, can be overwhelming and, at times, inscrutable. This is where data storytelling comes into play, transforming complex data into compelling narratives that resonate with investors.

In this article, we delve into the importance of data storytelling, explore real-world examples of companies that have crafted engaging narratives, and share best practices to help you communicate effectively with your investors and stakeholders.

The importance of data storytelling

Investors are bombarded with information. To stand out, companies must present their data in a way that is not only clear and concise but also engaging. Data storytelling is the key to turning spreadsheets and metrics into meaningful insights. It helps investors understand the context, grasp the significance of the numbers, and remember the message long after the presentation is over.

Business storytelling example: Walmart

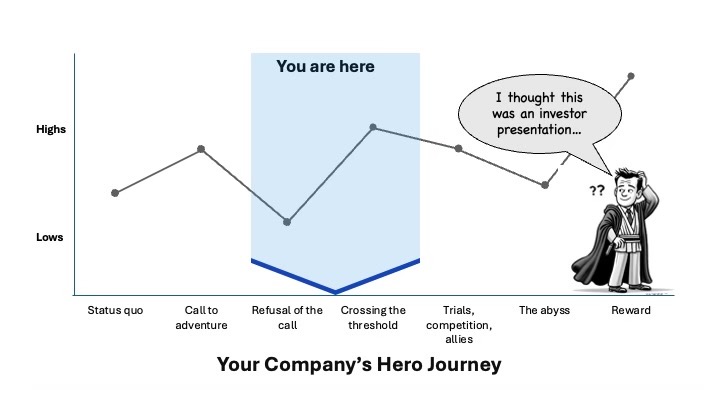

The most common story archetype is the Hero’s journey. The “Star Wars” trilogy is a classic example, in which Luke Skywalker embarks on a journey of transformation from farm boy to Jedi. Guided by mentor Obi-Wan, he confronts and redeems Darth Vader, facing trials and gaining allies along the way. His journey from ordinary to extraordinary restores peace, encapsulating departure, initiation, and return.

Traditional retailers like Walmart have had to undertake their own journey of transformation – evolving their operating model since the advent of E-commerce giants like Amazon. Walmart’s executives must tell the company’s story over multiple years to investors through Investor Days, quarterly earnings calls, 1:1 meetings, and they must tell it through the financial data they share.

Business storytelling example: Uber

Uber’s story is a different archetype, not unlike the film “Groundhog Day,” in which Bill Murray’s character loses his way – but ultimately discovers the need for change and he becomes a better person. Uber’s story parallels that of Bill Murray: it was a tech darling since its founding in 2009, experiencing hyper-growth in its first seven years and disrupting the transportation industry by creating a ride-sharing service enabled by the rise of smartphones, the app store, and the desire for on-demand work.

In 2017, Uber suffered a series of scandals about sexual harassment, discrimination, aggressive culture, and the sudden departure of senior executives – ultimately leading their CEO to step down after what the NY Times called a “shareholder revolt.”

As the company prepared to go public in 2019, their CEO and management team needed to demonstrate how the company had discovered the error of its ways – refocused on growth – and transformed into a better company with a strategic focus on innovation, operational excellence, and financial discipline.

Practical tips for data storytelling

Which type of storyline best suits the story you want to tell with your data?

Whatever archetype your corporate narrative follows, here are a few tips for making your investment narrative compelling and effective:

1. Begin with the end in mind: Before diving into the data, identify the key message or insight you want to convey. What should investors take away from your communication? Personally, I like to start with writing out the headline you would want business articles to say about your company’s results or strategy and work back from there.

2. Prioritize your audience: Investor Days and earnings calls have many audiences – long-term investors, short-term holders, equity analysts, press, employees, partners, and vendors. It’s important to prioritize which audience you want to speak to first and foremost. Be ruthless in prioritizing your audience, speak their language, and proactively address their concerns.

3. Use visuals wisely: Visual aids like charts, graphs, and infographics can illustrate trends and relationships more effectively than text. However, avoid clutter and ensure each visual element supports your narrative.

4. Highlight data points sparingly: Less is more. Not all data is created equal. Emphasize the most critical data points that align with your story and support your investment thesis.

5. Highlight the hero behind the data: It’s hard to root for a number, but easier to identify with the person or team that is on a journey to deliver a particular success metric. Weave your data into your hero’s story with a beginning (setting the stage), middle (presenting the data), and end (concluding insights). Use analogies and metaphors to make complex data relatable.

6. Proactively address concerns in your data: If your data is inconsistent with your narrative, own this or explain why, but do tell them how you are addressing any potential issue. They will appreciate your transparency and candor

Data storytelling is not just a tool for investor communications – it’s an essential skill in today’s data-driven world. By mastering the art of transforming numbers into narratives, you can engage your investors on a deeper level, foster trust, and guide them through your company’s journey with clarity and confidence. Remember, the goal is not just to inform but to inspire belief in your company’s strategy and your ability to deliver on your ambitious vision.

I write about business strategy and finance. If you found this helpful, please share it. I appreciate your support.

Learn more about how I help clients build their investor relations playbook here.